Your sophisticated value proposition is losing to vendors who ship CAD models overnight.

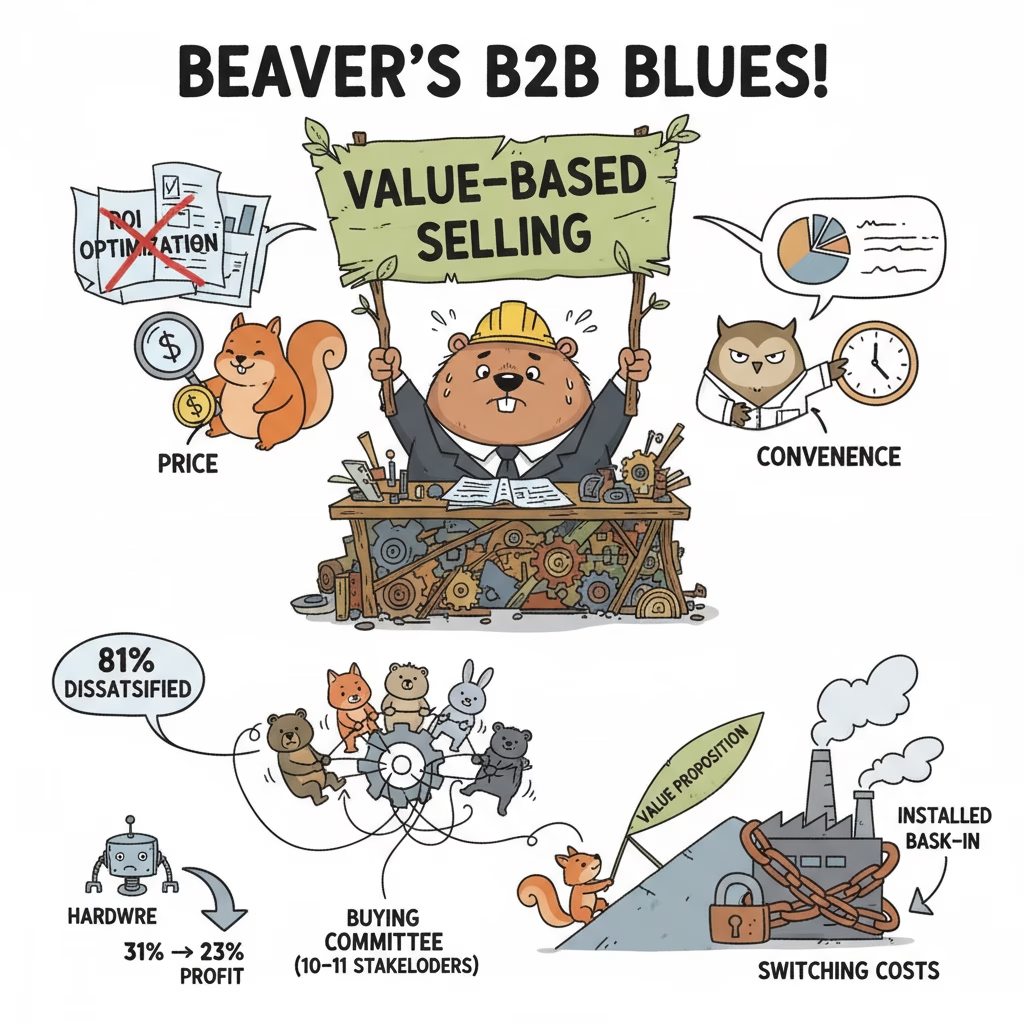

For decades, sales consultants have championed value-based selling as the superior methodology for B2B companies. The pitch is compelling: stop competing on price, start selling outcomes, quantify the ROI your product delivers, and align your pricing with the value you create. According to 2025 research, 66% of manufacturers report their content isn’t converting, and 64% struggle to prove ROI – suggesting the value-based selling playbook isn’t working as advertised. In technical B2B manufacturing, where engineers specify components, procurement negotiates contracts, and products increasingly resemble commodities, value-based selling often collapses under the weight of its own assumptions.

This article dissects the systematic failures of value-based selling in industrial contexts. We examine six fundamental failure modes, supported by research from Bain & Company, MIT Sloan Management Review, Corporate Visions’ 2025 B2B buying behavior study, and direct testimony from engineers and procurement professionals. If you sell machinery, automation equipment, sensors, valves, actuators, or electromechanical assemblies, the gap between VBS theory and your daily reality is likely enormous. Understanding why value-based selling fails is the first step toward adopting strategies that actually work in 2025 and beyond.

What Value-Based Selling Actually Assumes (And Why That Matters)

Value-based selling rests on a deceptively simple premise. Instead of selling features or competing on price, you quantify the economic value your product creates for the customer. You might calculate reduced downtime, increased throughput, lower energy consumption, or improved yield. You then price your product as a fraction of that value, creating a win-win: the customer captures most of the value, you capture higher margins than cost-plus pricing would allow.

This methodology makes five foundational assumptions. First, buyers make rational, ROI-driven decisions. Second, value can be quantified and communicated credibly. Third, the customer organization will actually realize the promised value. Fourth, there exists a unified “customer” who agrees on what constitutes value. Fifth, your product offers defensible differentiation that justifies a value-based price premium.

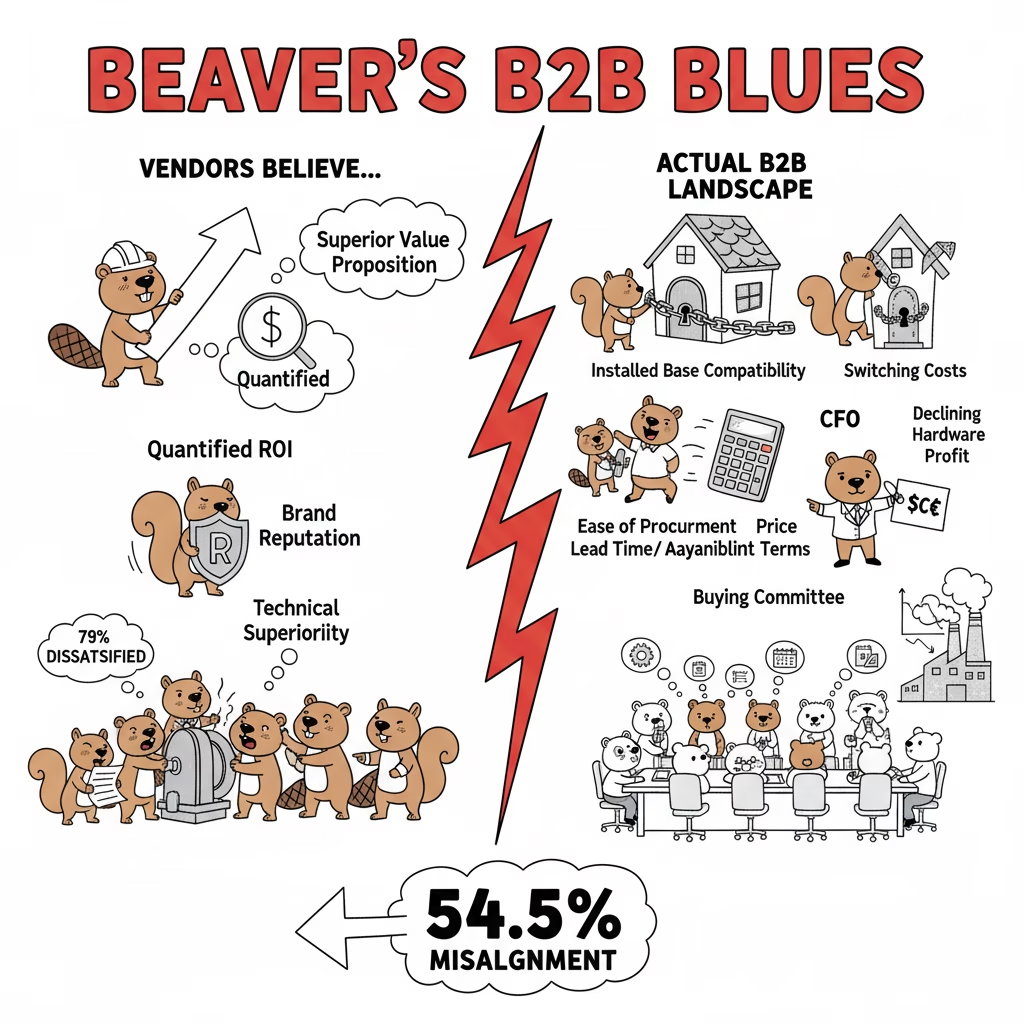

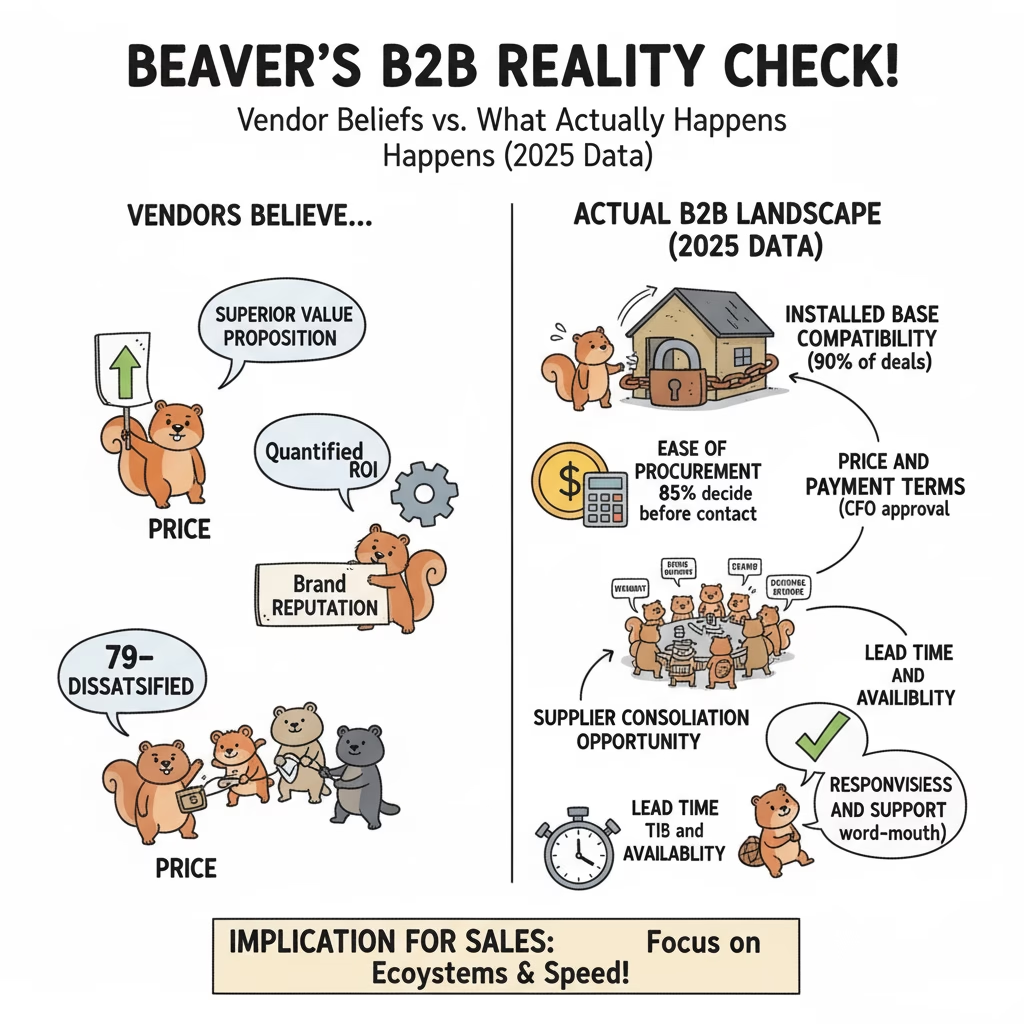

These assumptions hold reasonably well in certain B2B contexts. A SaaS platform that demonstrably reduces customer acquisition cost by 30% can credibly sell on value. A consulting firm that restructures operations to save $5M annually can price based on outcomes. The value is measurable, the buyer is sophisticated, and the differentiation is clear. However, 2025 data reveals a troubling disconnect: there’s an average 54.5% misalignment between how sellers and buyers perceive the core problem to be solved, and buyers change their problem statement an average of 3.1 times during complex purchases. This suggests value-based selling’s foundational assumptions are increasingly fragile.

Key Takeaway: Value-based selling works when buyers are rational, value is quantifiable, customer organizations are functional, stakeholders agree on priorities, and products are clearly differentiated. Technical B2B manufacturing routinely violates all five assumptions, creating a 54.5% average misalignment between seller and buyer problem definitions.

Failure Mode #1: The Myth of the Rational Technical Buyer

Value-based selling assumes purchasing decisions flow from logical ROI analysis. Build a compelling business case, demonstrate superior value, win the deal. This assumption crumbles when you examine how engineers and procurement professionals actually select vendors in 2025.

In a candid discussion on Reddit’s r/AskEngineers forum, working engineers revealed their real vendor selection criteria. The top-voted response was brutally honest: “Do they provide spec sheets and manuals without annoying ‘sign up’ bullshit? Do they have CAD models I can easily dump into my designs? Do they provide pricing with little or no effort from me? Do they communicate or just ghost me? Those four questions make most of my decisions for COTS parts, components and raw materials.”

Another engineer elaborated: “Basically what goes in the early prototypes will quite likely wind up in the production units unless there is a real problem, and what goes in the early prototypes is driven mostly by what is least annoying to source a handful of.” A third engineer summarized: “Seriously, making my life easy is probably 50% of the decision.”

Notice what’s absent from these criteria. No mention of ROI. No discussion of total cost of ownership. No value quantification. Engineers optimize for convenience: easy access to CAD models, clear documentation, responsive support, and simple sample ordering. Your sophisticated value proposition is competing against a vendor who ships samples overnight with no paperwork. According to Corporate Visions’ 2025 research, 85% of buyers have largely established their purchase requirements before contacting sellers, meaning your value proposition arrives after the decision framework is already set.

Procurement departments operate under different constraints, but they’re equally indifferent to your value story. One engineer described the dynamic: “Engineers will select the component that meets the requirements and specifications. Then buyer will beat up the supplier on price. If the supplier does not yield on price, then typically it is back to the drawing board to find another component.” Another added: “Generally I pick the vendors that will make the best part. Then a program manager will shit on the pricing and pick cheaper suppliers. We’ll build protos using the vendors picked by engineering and pat ourselves on the back for doing a great job. Then we go to production and the aforementioned PM will get the parts moved to the cheaper supplier. Production won’t work well, yield will be bad and we’ll have 17 meetings about how to improve things.”

The punchline: “PM is happy because he saved so much money. Engineers don’t get a bonus because the project wasn’t on time. Then we do it all over next year on the next project.” This is organizational reality in 2025. Your value proposition is irrelevant to both parties. Engineers want convenience. Procurement wants price concessions. Neither is optimizing for the value you’re selling. This aligns with 2025 data showing that 81% of buyers express dissatisfaction with their chosen providers—suggesting the current decision-making process is broken for everyone involved.

Key Takeaway: Engineers select vendors based on CAD model availability, documentation quality, and responsiveness—not value propositions. Procurement overrides engineering selections based on price. Your ROI calculator is solving a problem neither stakeholder has, which explains why 81% of B2B buyers report dissatisfaction with their chosen providers.

Failure Mode #2: The Predictability vs. Value Trade-Off

Outcome-based pricing represents the purest form of value-based selling. Why charge a fixed price when you could align payment with actual results? If your equipment increases production by 20%, charge a percentage of that gain. If your sensor reduces defects by 15%, price based on scrap savings. Perfect alignment, perfect fairness.

Perfect failure. A revealing case study from an AI-powered SaaS company illustrates why. The company built a product that delivered measurable, quantifiable value. They offered a pay-per-outcome pricing model that perfectly aligned incentives. Sales stalled for months. The problem wasn’t the product or the value proposition. The problem was the pricing model itself.

“It sounds foolish,” the founder reflected, “why wouldn’t a customer want to pay only for the value produced? But ultimately, enterprise customers valued predictability more. They wanted to know how much this would cost them.” When the company switched to a simple, predictable subscription fee—completely detached from usage or outcomes—sales accelerated dramatically. This pattern is confirmed by 2025 research showing that 78% of B2B buyers expect ROI within 6 months of implementing software, creating pressure for predictable, defensible costs rather than variable pricing tied to uncertain outcomes.

CFOs and finance departments operate on fixed budgets and predictable cost forecasts. A variable, outcome-based price introduces uncertainty that is often unacceptable, even if the expected value is superior. The certainty of a $50,000 annual subscription is more valuable than the possibility of paying anywhere from $30,000 to $70,000 depending on outcomes, even if $50,000 is the mathematical expectation of the variable model. With 79% of B2B purchases requiring CFO approval as the final decision maker in 2025, this predictability preference has become non-negotiable.

Bain & Company research on the machinery and equipment sector confirms this pattern. While outcome-based pricing is theoretically optimal, “the reality is few outcome-based pricing and sales models will be that extreme in the short term.” The consulting firm notes that even in industries where value could be tied directly to production output or equipment uptime, the complexity and unpredictability make such models impractical for widespread adoption.

The machinery manufacturer who tries to charge per unit produced faces a customer who asks: “What if we run three shifts instead of two? What if we change product mix? What if we have a quality issue that’s not your fault but reduces our output?” Every contingency requires negotiation. Every variance requires explanation. The cognitive and administrative overhead overwhelms any theoretical benefit from perfect value alignment.

Key Takeaway: Enterprise customers consistently choose simple, predictable pricing over theoretically optimal outcome-based models. Budget certainty trumps perfect value alignment, especially when 79% of purchases require CFO approval. Your sophisticated pricing model is a bug, not a feature.

Failure Mode #3: Customer Internal Dysfunction Kills ROI Promises

Value-based selling assumes the customer organization is a rational, efficient machine capable of realizing the full value of your solution. Build the ROI model, demonstrate the savings, close the deal. This assumption ignores a reality that experienced procurement professionals understand intimately: their own organizations are dysfunctional. Corporate Visions’ 2025 research reveals that only 38% of CEOs report having the right data and insights to achieve their commercial goals, suggesting internal organizational dysfunction is pervasive, not exceptional.

Robin Landy, a procurement consultant, articulates this with unusual candor: “Ironically, at the heart of effective procurement, are decision makers’ profound understanding of the dysfunction inside their own organisation. It is the dysfunction that will prevent them from realising the full benefits of whatever they’re buying; but awareness of the dysfunction which gives them a truer understanding of the benefits.”

Consider a vendor selling an AI-powered solution to reduce customer churn. The ROI calculation assumes the customer’s retention team will diligently follow up on every lead the AI identifies. But what if the retention team is incentivized by quarterly bonuses? They’ll ignore leads for customers whose contracts expire after the current quarter. The AI works perfectly. The value evaporates because of internal incentive misalignment.

Or consider a health insurer evaluating a predictive health solution. The vendor’s ROI model shows millions in savings from pre-emptive interventions that prevent expensive hospitalizations. The insurer’s procurement team smiles politely and discounts the ROI by 70%. Why? Because the at-risk policyholders are likely to churn to a competitor before the multi-year savings materialize. The insurer would be paying to reduce a competitor’s costs. The vendor’s ROI calculator is based on a fantasy of policyholder stability that doesn’t exist.

In technical manufacturing, this dysfunction manifests in the engineering-versus-program-management conflict described earlier. Engineers select the best component. Program managers override for cost savings. Production yield suffers. Meetings proliferate. The vendor’s value proposition—superior reliability, lower total cost of ownership—is destroyed by the customer’s internal incentive structure that rewards program managers for purchase price reduction, not lifecycle value optimization. This explains why 83% of sales leaders in 2025 admit their teams struggle to adapt to changing buyer needs and expectations—the needs themselves are contradictory and internally inconsistent.

Landy calls the vendor’s ROI calculator a “great big bear trap” because it’s built on assumptions of organizational rationality that don’t hold. Savvy buyers discount vendor ROI promises by 50% or more, not because they distrust the vendor’s math, but because they understand their own organization’s capacity to sabotage value realization.

Key Takeaway: Experienced buyers heavily discount vendor ROI promises because they understand their own organization’s internal dysfunctions, perverse incentives, and structural barriers to value realization. With only 38% of CEOs having the right data to achieve commercial goals, your ROI calculator assumes a functional customer organization that statistically doesn’t exist.

Failure Mode #4: Multi-Stakeholder Value Fragmentation

Value-based selling assumes a unified “customer” who agrees on what constitutes value. This assumption is fiction. In complex B2B sales, there is no single customer. There is a buying committee composed of multiple stakeholders from different departments, each with their own priorities, metrics, and career incentives. According to 2025 research, the average buying group has grown to include at least 10-11 stakeholders, with multi-national deals expanding to an average of 15.2 people. More critically, 52% of buying groups now include decision makers at VP level or above, each with distinct success metrics.

Engineering cares about technical specifications, reliability, and ease of integration. They want components that meet exact tolerances, have well-documented APIs, and integrate cleanly with existing systems. Finance cares about predictable costs, budget adherence, and quantifiable ROI. They want fixed pricing, clear payment terms, and defensible business cases. Procurement is measured on achieving price reductions and favorable contract terms. They want volume discounts, extended payment terms, and the ability to show year-over-year cost savings. Operations cares about uptime, throughput, and minimizing disruption to existing workflows. They want proven reliability, fast delivery, and minimal installation complexity.

These priorities don’t just differ. They actively conflict. A feature that is highly valuable to engineering—advanced materials that enable tighter tolerances—may be seen as an unnecessary cost by finance if its contribution to ROI is not immediately obvious. A pricing model that is attractive to finance—pay-per-use that aligns cost with value—may be an operational nightmare for the plant manager who needs predictable access to equipment without worrying about usage meters. With final decisions requiring alignment from at least 5 key stakeholders in 2025, this fragmentation has become the primary barrier to value-based selling success.

The table below illustrates how different stakeholders define “value” for the same industrial sensor product:

| Stakeholder | Primary Metric | Definition of “Value” | Decision Criteria | Veto Power |

|---|---|---|---|---|

| Engineering | Technical performance | Accuracy, response time, integration ease | Meets specs, has CAD models, good documentation | Can block on technical grounds |

| Finance/CFO | Budget impact | Predictable cost, clear ROI | Fixed price, fits budget, defensible business case | Final approval (79% of deals) |

| Procurement | Cost reduction | Lower price than last year, favorable terms | Discount vs. list price, payment terms, volume pricing | Can force vendor switch |

| Operations | Uptime and reliability | No production disruption, fast replacement | Proven track record, stock availability, support response time | Can block on risk grounds |

| Maintenance | Ease of service | Simple calibration, common spare parts | Compatible with existing tools, local service availability | Influences operations decision |

Value-based selling provides no framework for reconciling these conflicting definitions. You can’t optimize for all five simultaneously. If you emphasize technical superiority to engineering, finance sees cost bloat. If you emphasize ROI to finance, procurement sees an opening to negotiate price down. If you emphasize reliability to operations, maintenance worries about proprietary service requirements. With buying cycles now spanning an average of 11.5 months (16 months for multi-national deals), these conflicts have more time to derail deals.

The fragmentation creates an impossible optimization problem. Most vendors default to a generic value proposition that tries to satisfy everyone and ends up resonating with no one. Or they pick one stakeholder to champion their solution, only to have another stakeholder veto the purchase for reasons the champion doesn’t control. This explains why 86% of B2B purchases stall during the buying process in 2025—stakeholder misalignment is the norm, not the exception.

Key Takeaway: B2B buying committees average 10-11 stakeholders (15.2 for multi-national deals) with fragmented, conflicting definitions of value. Engineering wants technical performance, finance wants predictable ROI, procurement wants price concessions, operations wants reliability. Value-based selling assumes a unified customer that statistically doesn’t exist, contributing to 86% of purchases stalling.

Failure Mode #5: Hardware Commoditization and the Differentiation Illusion

Value-based selling requires defensible, substantial differentiation. If customers perceive your product as interchangeable with alternatives, the conversation inevitably gravitates to price. In mature manufacturing markets, this is exactly what has happened. Products that vendors believe are differentiated are perceived by customers as commodities. The data from 2025 confirms this trend is accelerating, not slowing.

Bain & Company research on the machinery and equipment sector documents this trend with precision. “Growing competition and slowing device-centric innovation have made it more challenging for machinery and equipment companies to succeed based on machine performance alone.” The data is stark: in the industrial automation sector, hardware is expected to decrease from approximately 31% of company profit today to just 23% by the end of the decade. The remaining profit must come from software, services, and solution offerings that bundle equipment with value-added services.

This eight-percentage-point decline in hardware profit contribution represents a fundamental shift. As hardware commoditizes, value-based differentiation on equipment specifications becomes impossible. Companies with mature portfolios of solutions combining hardware, software, and services achieved average annualized total shareholder returns of 32% from 2019 through 2021. Companies that focused primarily on hardware value propositions achieved just 4%. The market has spoken: hardware-only value propositions are dying.

The commoditization is even more extreme in component markets. Industrial bearings provide a telling example. A 1986 government study noted that “the stability of the commodity sector of the bearing industry has deteriorated to the point where it now sits upon a precipice ready to collapse.” Nearly 40 years later, the situation has only intensified with global manufacturing competition. There is no “value-based selling” in commodity bearings. There is price per unit, lead time, and availability.

Fastener distribution operates on explicit cost-plus pricing. Market research confirms that “companies in this industry often compete on price, and cost-plus pricing is a simple and easy way to set prices that are competitive.” A vendor attempting to differentiate on the “value” of their specific fastener is fundamentally misunderstanding the market. Customers don’t optimize fastener selection. They optimize supplier consolidation.

This reveals a critical insight about MRO (maintenance, repair, and operations) procurement. Buyers don’t select vendors based on “value per component.” They select based on supplier consolidation opportunities, e-procurement integration, stock availability, and logistics efficiency. A bearing vendor trying to sell value on technical merits is missing the point. The customer wants to reduce the number of suppliers they manage from 50 to 5, not optimize each bearing selection.

The table below shows how commoditization has progressed across different industrial product categories:

| Product Category | Commoditization Status | Primary Selection Criteria | VBS Viability | Profit Trend |

|---|---|---|---|---|

| Industrial bearings | Fully commoditized (since 1980s) | Price, availability, supplier consolidation | None | Declining |

| Fasteners | Fully commoditized | Cost-plus pricing, volume discounts | None | Flat |

| Basic sensors | Highly commoditized | Price, lead time, ease of integration | Very low | Declining |

| Standard motors/drives | Moderately commoditized | Price, efficiency ratings, availability | Low | Declining |

| Automation equipment (hardware) | Commoditizing rapidly | Installed base compatibility, ecosystem | Low (hardware), Medium (solutions) | Declining (31%→23% by 2030) |

| Custom machinery | Still differentiated | Application fit, engineering support | Medium to High | Stable |

| Average across categories | Accelerating commoditization | Price + convenience dominate | Low to none | Declining |

The progression is clear. As products mature and competition intensifies, differentiation erodes. What starts as a highly engineered, differentiated product becomes a commodity within 10 to 20 years. Vendors who continue to invest in value-based selling for commoditized products are fighting market reality. This aligns with the 2025 finding that 66% of manufacturers report their content isn’t converting—they’re creating value-based content for products customers perceive as commodities.

Key Takeaway: Hardware commoditization is accelerating across industrial markets. Bain research shows hardware profit contribution declining from 31% to 23% by 2030. For commodity components like bearings and fasteners, value-based selling is impossible—customers optimize for price, availability, and supplier consolidation, not component-level value. This explains why 66% of manufacturers report content conversion failures.

Failure Mode #6: Path Dependency and Installed Base Lock-In

In many technical hardware markets, the customer’s existing installed base creates switching costs that overwhelm any value proposition from a competing vendor. This is particularly acute in industrial automation, where PLCs, drives, HMIs, and other control systems form tightly integrated ecosystems. According to 2025 research, 84% of buyers choose vendors they’ve worked with before, and 90% of buyers have prior experience with at least one vendor they evaluated. More dramatically, 90% of deals are won by vendors from the buyer’s initial consideration set—meaning if you’re not already in the ecosystem, your value proposition is statistically irrelevant.

A discussion on Reddit’s r/PLC forum about vendor selection (Siemens versus Allen Bradley) reveals the reality. Engineers have strong technical preferences. One noted: “I like that Siemens PLCs let you change Function Blocks without stopping the PLC. Allen Bradley requires a PLC stop/start to change an AOI.” Another highlighted: “Siemens also allowing for Modbus TCP natively without a ton of bullshit makes it a lot more versatile out of the box.”

But when asked why they would choose one vendor over another, the overwhelming consensus was: “To give the customer what the customer wants.” One engineer elaborated: “Been using S7 400 for 15 years. New model is backwards compatible, just plug and play. AB would change firmware 20 times, causing need for multiple licenses. Siemens is pretty solid. But ultimately it’s what the customer wants.”

Another engineer summarized: “If I’m just doing a self-contained system, it’s whatever the customer wants.” The real drivers of vendor selection are not technical merit or value propositions. They are the customer’s existing platform, maintenance team familiarity, spare parts inventory, and software licenses already owned. This aligns with 2025 data showing that word-of-mouth recommendations carry the highest weight, with 73% of buyers ranking it as their most trusted source—and existing vendor relationships are the ultimate form of “word-of-mouth.”

This is path dependency in action. The customer made a platform decision 15 to 20 years ago. That decision determines current purchases regardless of which vendor offers “more value” today. A Siemens salesperson cannot “sell value” to an Allen Bradley shop. The switching costs are too high. The customer would need to retrain their entire maintenance team, replace their spare parts inventory, purchase new software licenses, and rewrite their existing control programs. The value proposition would need to be extraordinary—10x better, not 20% better—to justify those costs.

The switching costs are not just financial. They’re organizational and cognitive. The maintenance team knows Allen Bradley. They can troubleshoot problems quickly. They have relationships with local distributors. They’ve built up institutional knowledge over decades. Asking them to switch to Siemens is asking them to become novices again. The resistance is rational. With over 90% of customers reporting satisfaction with their current vendor relationships in 2025, the installed base advantage is nearly insurmountable.

This dynamic extends beyond PLCs to any product category with strong ecosystem effects. ERP systems, CAD software, machine tool brands, hydraulic component families—all exhibit installed base lock-in. The vendor who won the initial platform decision 20 years ago has an almost insurmountable advantage. Competitors can’t overcome it with better value propositions. They can only win greenfield projects or wait for the incumbent to make a catastrophic mistake.

Key Takeaway: Installed base lock-in creates switching costs that overwhelm value propositions. In industrial automation, customers choose vendors based on existing platform, not technical merit. Path dependency means platform decisions made 15-20 years ago determine current purchases regardless of which vendor offers “more value” today. With 90% of deals won by vendors in the initial consideration set and 84% of buyers choosing familiar vendors, conquest selling via value propositions is statistically futile.

What Actually Drives Vendor Selection in Technical B2B (The Inconvenient Truth)

If value propositions don’t drive vendor selection, what does? The research reveals a rank-ordered list of actual decision factors that bears little resemblance to what sales consultants teach. Understanding this hierarchy is critical for manufacturers trying to navigate the 2025 buying landscape, where buyers don’t engage until they’re 69% of the way through their journey and 80-90% have their vendor shortlist before starting research.

First, installed base compatibility. If the customer has an existing platform, ecosystem compatibility trumps everything else. This is non-negotiable in automation, software, and any product category with integration requirements. With 90% of deals won by vendors from the buyer’s initial consideration set, if you’re not in the ecosystem, you’re not in the deal.

Second, ease of procurement. Engineers want CAD models they can download instantly, datasheets without registration walls, pricing without requiring a sales call, and samples shipped overnight. One engineer summarized: “I have a lot of stuff with Samtec connectors in it basically because of their no nonsense approach to samples.” Convenience beats value propositions. This matters more in 2025 because 85% of buyers have largely established their purchase requirements before any seller contact—meaning procurement friction eliminates you before value discussions begin.

Third, price and payment terms. Procurement departments are measured on cost reduction. They will override engineering selections if they can find a cheaper alternative that meets minimum specifications. The value proposition is irrelevant if procurement can show 15% cost savings. With 79% of purchases requiring CFO approval as the final decision maker, price scrutiny has intensified.

Fourth, supplier consolidation opportunities. For MRO and component purchases, customers want to reduce supplier count. A vendor who can supply 80% of their needs from one source beats a vendor with a superior product in one category but no breadth. This explains the success of distributors like Fastenal and Grainger—they win on breadth, not value.

Fifth, lead time and availability. Stock availability and fast delivery often matter more than technical superiority. A component that’s in stock today beats a better component that requires a 12-week lead time. In 2025’s volatile supply chain environment, this factor has become more critical than ever.

Sixth, responsiveness and support. Engineers value vendors who answer technical questions quickly, provide application support, and don’t ghost them after the sale. This is relationship-based, not value-based. With 73% of buyers ranking word-of-mouth as their most trusted source, responsive support creates the referrals that drive future business.

Seventh, and often last, is the value proposition itself. By the time a customer evaluates your ROI calculator, they’ve already filtered on the six factors above. If you don’t pass those filters, your value proposition never gets considered. This explains why only 9% of buyers consider vendor websites reliable sources of information in 2025—the value propositions on those websites are irrelevant to the actual decision criteria.

The table below contrasts what vendors believe drives decisions versus what actually drives them:

| Rank | What Vendors Believe | What Actually Happens (2025 Data) | Implication for Sales |

|---|---|---|---|

| 1 | Superior value proposition | Installed base compatibility (90% of deals) | Don’t fight ecosystem lock-in, focus on expansion |

| 2 | Quantified ROI | Ease of procurement (85% decide before contact) | Optimize for engineer convenience, remove friction |

| 3 | Technical superiority | Price and payment terms (79% need CFO approval) | Be competitive on price or don’t compete |

| 4 | Brand reputation | Supplier consolidation opportunity | Expand product breadth, not depth |

| 5 | Customer relationships | Lead time and availability | Stock inventory, guarantee delivery |

| 6 | Sales process quality | Responsiveness and support (73% trust word-of-mouth) | Answer questions fast, build referrals |

| 7 | Pricing strategy | Value proposition (only 9% trust vendor websites) | Value prop is table stakes, not differentiator |

This ranking explains why so many value-based selling initiatives fail. Vendors invest heavily in ROI calculators, value assessment tools, and sales training on consultative selling. Meanwhile, customers are filtering them out because they don’t have CAD models available for download or because their lead time is 16 weeks instead of 4. The 2025 data confirms this: buyers don’t engage until 69% through their journey, and by then, the vendors who failed on factors 1-6 are already eliminated.

Key Takeaway: Value propositions rank seventh in actual purchase decisions, behind installed base compatibility (90% of deals), procurement ease (85% decide before contact), price (79% ), supplier consolidation, lead time, and responsiveness (73% trust word-of-mouth). Vendors who optimize for value while ignoring the top six factors lose to vendors who get the basics right.

Common Objections (And Why They’re Wrong)

Sales leaders reading this analysis often raise predictable objections. These objections reveal how deeply value-based selling dogma has penetrated B2B sales culture. Each objection crumbles under scrutiny.

Objection 1: “But our customers are different—they’re sophisticated buyers who care about total cost of ownership.”

Response: The data says otherwise. Corporate Visions’ 2025 research shows that 81% of buyers express dissatisfaction with their chosen providers, suggesting even “sophisticated” buyers are making suboptimal decisions. More critically, there’s a 54.5% average misalignment between how sellers and buyers perceive the core problem. If buyers were truly sophisticated and focused on TCO, this misalignment wouldn’t exist. The evidence suggests buyers are overconfident (91% come to sales meetings already familiar with the vendor) but not actually sophisticated in their decision-making.

Objection 2: “We just need to do value-based selling better—train our sales team more effectively.”

Response: This is the “no true Scotsman” fallacy. When a methodology fails, proponents claim it wasn’t implemented correctly. But 83% of sales leaders in 2025 admit their teams struggle to adapt to changing buyer needs. The problem isn’t execution—it’s that buyer needs are fragmented across 10-11 stakeholders with conflicting priorities. No amount of training can reconcile the fact that engineering wants technical performance, finance wants predictable costs, and procurement wants price reductions. These are structurally incompatible goals.

Objection 3: “Value-based selling works in our industry—we have case studies proving it.”

Response: Survivorship bias. You’re highlighting the deals that worked while ignoring the 86% of B2B purchases that stall during the buying process. Moreover, correlation doesn’t prove causation. Your “successful” value-based sales may have succeeded despite the value proposition, not because of it. If the customer was already in your installed base (84% choose familiar vendors), had an easy procurement experience, and found your price acceptable, the value proposition was irrelevant—you would have won anyway.

Objection 4: “If we abandon value-based selling, we’ll be forced to compete on price alone.”

Response: False dichotomy. The alternative to value-based selling isn’t price-based selling. It’s reality-based selling that acknowledges the actual decision criteria: installed base compatibility, procurement ease, supplier consolidation, lead time, and responsiveness. Companies like Samtec and Wurth Elektronik win on convenience. Fastenal and Grainger win on breadth. Rockwell and Siemens win on ecosystem lock-in. None of these strategies are “competing on price alone”—they’re competing on factors that actually matter to customers.

Objection 5: “Our product is genuinely differentiated—we have patents and unique technology.”

Response: Differentiation is in the eye of the customer, not the patent office. Bain research shows hardware profit contribution declining from 31% to 23% by 2030 precisely because customers increasingly perceive technical differences as irrelevant. Your patents may be real, but if customers can’t or won’t pay for that differentiation, it’s economically meaningless. The test is simple: can you command a price premium? If procurement routinely forces you to match competitor pricing, your differentiation is an illusion.

Key Takeaway: Common objections to abandoning value-based selling—”our customers are sophisticated,” “we need better training,” “we have case studies,” “we’ll compete on price,” “we’re truly differentiated”—all crumble under 2025 data showing 81% buyer dissatisfaction, 86% of purchases stalling, 84% choosing familiar vendors, and hardware profit declining 8 percentage points by 2030.

When to Abandon Value-Based Selling (Decision Framework)

Value-based selling is not universally wrong. It’s context-dependent. The framework below helps you determine when VBS is viable versus when you need alternative approaches. This decision matrix is grounded in 2025 market realities, not sales methodology theory.

The framework uses two dimensions: product differentiation (commodity versus differentiated) and market context (installed base lock-in versus greenfield). This creates four quadrants, each requiring a different sales approach.

| Market Context | Commodity Product | Differentiated Product |

|---|---|---|

| Greenfield / No Lock-In | Approach: Cost-plus or competitive pricing Focus: Price, availability, ease of procurement VBS Viability: None Example: Fasteners, commodity bearings 2025 Reality: 66% content conversion failure | Approach: Value-based selling may work Focus: Quantified ROI, application engineering VBS Viability: Medium to High Example: Custom machinery, specialized sensors 2025 Reality: Still requires passing convenience/price filters first |

| Installed Base Lock-In | Approach: Supplier consolidation play Focus: Breadth, e-procurement, logistics VBS Viability: None Example: MRO supplies, replacement parts 2025 Reality: 84% choose familiar vendors | Approach: Ecosystem expansion, not conquest Focus: Compatibility, upsell, cross-sell VBS Viability: Low (for conquest), Medium (for expansion) Example: PLCs, automation platforms 2025 Reality: 90% of deals won by vendors in initial consideration set |

The top-left quadrant (commodity product, greenfield market) is where value-based selling dies fastest. Customers perceive products as interchangeable. Price and availability dominate. Use cost-plus pricing, compete on logistics, and don’t waste resources on value propositions. The 2025 data showing 66% of manufacturers reporting content conversion failures is largely driven by vendors in this quadrant trying to create value-based content for commoditized products.

The bottom-left quadrant (commodity product, installed base lock-in) is MRO territory. Customers want supplier consolidation, e-procurement integration, and predictable availability. Position as a one-stop shop, not a value creator. With 84% of buyers choosing familiar vendors, conquest is futile—focus on becoming the familiar vendor through breadth and convenience.

The bottom-right quadrant (differentiated product, installed base lock-in) is where most technical manufacturers get stuck. You have a superior product, but customers are locked into a competitor’s ecosystem. Value-based selling won’t work for conquest—the 90% of deals won by vendors in the initial consideration set proves this. Focus on expanding within your own installed base and wait for greenfield opportunities.

The top-right quadrant (differentiated product, greenfield market) is the only place value-based selling has a reasonable chance. Even here, you must compete on convenience and price before value propositions matter. But if you clear those hurdles, a strong value story can close the deal. However, remember that 85% of buyers have established purchase requirements before seller contact, so your value proposition must align with their pre-existing problem definition or you’ll hit the 54.5% misalignment wall.

Key Takeaway: Value-based selling only works for differentiated products in greenfield markets—and even then, only after you’ve satisfied requirements for convenience, price, and availability. For commodity products or markets with installed base lock-in (representing 75% of the matrix), VBS is a waste of resources. The 2025 data confirms this: 90% of deals go to vendors in the initial consideration set, and 84% of buyers choose familiar vendors.

Alternative Sales Approaches That Actually Work in Technical Manufacturing

If value-based selling fails in most technical B2B contexts, what works instead? Five alternative approaches have proven effective in the 2025 market environment, each aligned with how customers actually make decisions rather than how sales theory says they should.

Convenience-First Selling. Optimize every aspect of the procurement experience for engineer ease. Provide CAD models in every major format (STEP, IGES, SolidWorks, AutoCAD). Publish complete datasheets without registration walls. Offer instant pricing online. Ship samples overnight with no paperwork. Answer technical questions within hours, not days. Engineers will specify your components not because of your value proposition, but because you make their lives easier. Samtec and Wurth Elektronik have built significant market share using this approach. This strategy directly addresses the 2025 finding that 85% of buyers have established purchase requirements before seller contact—if procurement is frictionless, you’re more likely to be in the consideration set.

Ecosystem Selling. If customers are locked into platforms, don’t fight it. Expand within your own installed base instead of trying to win customers from entrenched competitors. Develop complementary products that integrate with your existing offerings. Create switching costs through ecosystem effects. Offer migration paths from older products to newer ones that preserve customer investment. Rockwell Automation and Siemens both excel at this approach. With 90% of deals won by vendors from the buyer’s initial consideration set and 84% of buyers choosing familiar vendors, ecosystem expansion is statistically far more viable than conquest selling.

Supplier Consolidation Play. Position as a one-stop shop for MRO and component needs. Expand product breadth, not depth. Integrate with customer e-procurement systems. Offer vendor-managed inventory. Provide consolidated invoicing and reporting. Customers will pay a modest premium to reduce supplier count from 50 to 5. Fastenal and Grainger have built billion-dollar businesses on this model. This approach acknowledges that customers optimize for procurement efficiency, not component-level value—a reality confirmed by the engineer testimonials showing “making my life easy is 50% of the decision.”

Application Engineering Partnership. Instead of selling products, co-develop solutions. Embed your engineers with customer engineering teams. Solve application problems together. The relationship becomes the moat, not the product. This works particularly well for complex, custom applications where off-the-shelf products don’t fit. Many specialty sensor and actuator manufacturers use this approach. This strategy leverages the 2025 finding that 73% of buyers rank word-of-mouth as their most trusted source—embedded engineers generate the strongest possible “word-of-mouth” through daily collaboration.

Predictable Pricing Models. Abandon outcome-based pricing in favor of simple, predictable models. Fixed annual subscriptions. Tiered pricing based on clear usage bands. Volume discounts with transparent breakpoints. Customers value pricing certainty more than perfect value alignment. Make it easy for finance to budget and for procurement to compare alternatives. This directly addresses the 2025 reality that 79% of purchases require CFO approval and 78% of buyers expect ROI within 6 months—CFOs can’t approve variable pricing models, and 6-month ROI expectations require predictable costs.

Each approach requires different capabilities. Convenience-first selling requires investment in digital infrastructure and logistics. Ecosystem selling requires product development resources and platform thinking. Supplier consolidation requires breadth and operational excellence. Application engineering requires technical talent and customer intimacy. Predictable pricing requires discipline to resist the temptation of complex, “optimized” models. But all five approaches share a common thread: they align with how customers actually make decisions in 2025, not how sales theory says they should.

Key Takeaway: Five alternatives to value-based selling work in 2025’s technical B2B environment: convenience-first (addresses 85% deciding before contact), ecosystem selling (leverages 90% buying from initial set), supplier consolidation (acknowledges efficiency over value), application engineering partnership (builds 73% word-of-mouth trust), and predictable pricing (satisfies 79% CFO approval requirement).

Three Things to Do This Week

Understanding why value-based selling fails is valuable. Taking action is essential. Here are three concrete steps you can implement immediately to align your sales strategy with market reality.

1. Audit Your Product’s Actual Differentiation (Not Your Perceived Differentiation)

Call five recent customers and ask: “If we raised our price by 15% tomorrow, would you switch to a competitor?” If four out of five say yes, your product is commoditized regardless of your patents or technical specifications. Then ask: “What would we need to change for you to pay 15% more?” If they say “nothing could justify that,” you’re in a commodity market. Adjust your sales approach accordingly—stop investing in value propositions and start investing in convenience, breadth, or ecosystem lock-in.

2. Map Your Win/Loss Data to Actual Decision Criteria (Not Sales Methodology Criteria)

Review your last 20 wins and 20 losses. For each deal, score these factors on a 1-10 scale: installed base compatibility, procurement ease (CAD models, samples, documentation), price competitiveness, supplier consolidation fit, lead time, and responsiveness. Then score “quality of value proposition.” Run a correlation analysis. If value proposition quality has a correlation coefficient below 0.3 with win rate, stop optimizing it. If installed base compatibility has a correlation above 0.7, shift resources to ecosystem expansion. Let data, not dogma, drive your strategy.

3. Test Convenience-First Selling on One Product Line

Pick your highest-volume component or product. Remove all registration walls from datasheets and CAD models. Publish pricing online. Offer next-day sample shipping with no paperwork. Measure conversion rates for 90 days. Compare to your existing approach. If convenience-first outperforms value-based by 2x or more (likely, based on the research), roll it out across your portfolio. This single change addresses the 85% of buyers who decide before seller contact and the engineers who say “making my life easy is 50% of the decision.”

Key Takeaway: Three immediate actions: (1) audit actual differentiation via customer willingness-to-pay, (2) map win/loss data to real decision criteria not sales theory, (3) test convenience-first selling on one product line for 90 days. These tactical steps move you from value-based dogma to reality-based strategy.

Conclusion

Value-based selling systematically fails in technical B2B manufacturing because its core assumptions don’t hold. Buyers aren’t rational ROI optimizers—engineers optimize for convenience, procurement optimizes for price, and 81% of buyers end up dissatisfied with their choices. Value can’t be realized in dysfunctional customer organizations where only 38% of CEOs have the right data to achieve commercial goals. There is no unified customer—buying committees average 10-11 stakeholders (15.2 for multi-national deals) with fragmented, conflicting priorities requiring alignment from at least 5 key decision makers. Products aren’t differentiated—hardware profit contribution is declining from 31% to 23% by 2030 as commoditization accelerates. And installed base lock-in creates switching costs that overwhelm value propositions, with 90% of deals won by vendors from the buyer’s initial consideration set.

These aren’t implementation problems. They’re fundamental mismatches between VBS theory and manufacturing reality in 2025. The six failure modes documented in this article—rational buyer myth, predictability premium, internal dysfunction, stakeholder fragmentation, commoditization, and path dependency—occur across industries, company sizes, and product categories. They’re structural, not situational. The data is unambiguous: 66% of manufacturers report content isn’t converting, 64% struggle to prove ROI, 86% of purchases stall, and 84% of buyers choose familiar vendors. Value-based selling is failing at scale.

The solution isn’t better value-based selling. It’s abandoning VBS in contexts where it can’t work and adopting approaches aligned with how customers actually make decisions. Convenience-first selling for engineer-driven purchases. Ecosystem expansion for installed base markets. Supplier consolidation for MRO. Application engineering partnerships for custom solutions. Predictable pricing for enterprise buyers requiring CFO approval.

The path forward requires honesty about your market context. Audit your product differentiation through customer willingness-to-pay tests. Map installed base lock-in across your target market. Identify real decision criteria through win/loss correlation analysis. Test what customers care about through controlled experiments. Measure what correlates with wins, not what sales theory says should correlate. Then adapt your strategy to reality, not sales methodology dogma.

Success in technical B2B manufacturing comes from understanding market constraints and working within them, not from forcing a sales methodology that assumes constraints don’t exist. The manufacturers who thrive in 2025 and beyond will be those who abandon the value-based selling mirage and build strategies grounded in how engineers actually select vendors, how procurement actually makes decisions, and how buying committees actually navigate conflicting priorities. Better to succeed with a “simple” approach than fail with a “sophisticated” one that ignores market reality.

Ready to build a sales and marketing strategy grounded in how your customers actually buy? Join our community of technical B2B manufacturers who are moving beyond sales mythology to build approaches that work in the real world.

References

- Harris, N. (2025, May 23). Manufacturing Marketing Challenges of 2025 (and How to Fix Them). New Perspective. https://www.npws.net/blog/manufacturing-marketing-challenges

- Rius, A. (2025, January 14). B2B Buying Behavior in 2025: 40 Stats and Five Hard Truths That Sales Can’t Ignore. Corporate Visions. https://corporatevisions.com/blog/b2b-buying-behavior-statistics-trends/

- Priemer, D. (n.d.). Salespeople Need To STOP Selling “Value”. Predictable Revenue. https://predictablerevenue.com/blog/salespeople-need-to-stop-selling-value-with-david-priemer/

- Reddit. (2024). Why value-based pricing of an AI product failed. r/SaaS. https://www.reddit.com/r/SaaS/comments/1j956m2/why_valuebased_pricing_of_an_ai_product_failed/

- Straehle, O., Bron, A., & Crabbe, D. (2022). The Hardware Paradox: Machinery Must Expand beyond Machines. Bain & Company. https://www.bain.com/insights/hardware-paradox-global-machinery-and-equipment-report-2022/

- Landy, R. (2023, March 10). The collision of value-based pricing, customer dysfunction and ROI promises. Robin Landy Ltd. https://www.robinlandy.com/blog/the-collision-of-value-based-pricing-customer-dysfunction-and-roi-promises

- Reddit. (2021). How do you decide which vendors to use in building products and components? r/AskEngineers. https://www.reddit.com/r/AskEngineers/comments/r83f1e/how_do_you_decide_which_vendors_to_use_in/

- Reddit. (2022). Why would you choose Siemens over Allen Bradley? r/PLC. https://www.reddit.com/r/PLC/comments/yxq7wb/why_would_you_choose_siemens_over_allen_bradley/

- Bertini, M., Koenigsberg, O., & Snelgrove, T. (2024, May). Acing Value-Based Sales. MIT Sloan Management Review. https://sloanreview.mit.edu/article/acing-value-based-sales/

- Keränen, J., Totzek, D., Salonen, A., & Kienzler, M. (2023). Advancing value-based selling research in B2B markets. Industrial Marketing Management, 111, 1-13. https://www.sciencedirect.com/science/article/pii/S0019850123000226