You’ve invested in customer research. You’ve conducted surveys, held focus groups, and analyzed feedback. Your product roadmap is packed with features customers requested. Yet somehow, your competitors are discovering entirely new markets while you’re stuck optimizing existing ones.

What if the most valuable insights about your product aren’t coming from what customers say they want, but from what they’re already doing with it?

The Innovation Trap Hiding in Your Customer Feedback

Most B2B hardware and technology companies are caught in what innovation experts call the “feedback loop trap.” You ask customers what they want, they tell you based on their current experience, and you build incremental improvements to existing applications. Rinse and repeat.

The problem? Your customers can only articulate needs within the boundaries of their own experience. They can’t describe solutions to problems they don’t yet know they have. They can’t imagine applications that don’t exist in their world.

Meanwhile, somewhere in your customer base, someone is using your product in a way you never intended. They’re “hacking” it, adapting it, or combining it with other tools to solve a problem you didn’t even know existed. And that improvisation? It might be worth billions.

When Gaming Graphics Cards Became AI Supercomputers

In the late 1990s, NVIDIA was laser-focused on one market: PC gaming. Their Graphics Processing Units (GPUs) were designed to render complex 3D graphics for games like Quake and Unreal Tournament. That was the job. That was the market.

But by the early 2010s, something unexpected was happening. Researchers at Google, Stanford, and NYU weren’t using NVIDIA GPUs to play games—they were using them to train artificial intelligence models.

Why? The parallel processing architecture designed for rendering millions of pixels simultaneously turned out to be perfect for the computationally intensive matrix calculations required in deep learning. These researchers didn’t ask NVIDIA to build an AI chip. They simply discovered that gaming hardware could do something its creators never imagined.

The breakthrough moment came in 2012 when Alex Krizhevsky used NVIDIA GPUs to win the ImageNet competition, crushing competitors using traditional approaches. NVIDIA could have dismissed this as an interesting edge case. Instead, they leaned in.

Today, NVIDIA controls approximately 95% of the GPU market for machine learning and is valued at over $3 trillion. The company that made gaming graphics cards became the backbone of the AI revolution—not by asking customers what they wanted, but by observing what they were already doing.

The Lesson: Your Product’s Biggest Market Might Not Be the One You’re Selling To

NVIDIA’s transformation wasn’t the result of traditional market research. It came from paying attention to emergent user behavior—the unexpected, creative, and sometimes “off-label” uses of their technology.

From Student Projects to Factory Floors: Arduino’s Industrial Evolution

Arduino started with a simple mission: make electronics accessible to art students and hobbyists. The open-source platform was designed for people with zero programming or engineering background to create interactive projects.

Fast forward to 2022, and Arduino closed a $32 million Series B funding round led by Robert Bosch Venture Capital. What changed?

The users grew up.

Engineers who learned on Arduino boards in high school and college entered the workforce—and they brought Arduino with them. They started using these “toy” development boards for industrial prototyping, process control, and IoT applications. Companies like Steelcase began using Arduino for industrial machine monitoring.

Arduino’s co-founder Massimo Banzi explained: “Engineers in Gen Z and Millennial generations grew up using Arduino boards in STEM programs around the world, and they’ve become accustomed to the accessibility, simplicity and power of the company’s open-source hardware, software and cloud services. They’re now taking those demands into the enterprise.”

Rather than fighting this shift or dismissing it as misuse of an educational tool, Arduino launched the Arduino PRO line—industrial-grade versions with enhanced security, connectivity, and the ability to operate in harsh environments. They followed their users from the classroom to the factory floor.

The Lesson: Your “Unintended” Users Might Be Your Most Valuable Market Signal

When customers use your product in ways you didn’t plan, they’re showing you where the market is heading—often years before traditional research would reveal it.

The $10 Million Question: How Do You Systematically Find These Hidden Opportunities?

Observing emergent user behavior isn’t about getting lucky. There are proven frameworks for systematically discovering these hidden market opportunities.

1. The Lead User Method: Find the Future by Looking at the Edges

Developed by MIT professor Eric von Hippel, the Lead User Method is based on a powerful insight: some users face needs months or years before the mainstream market encounters them.

These “lead users” aren’t just early adopters—they’re actively innovating because existing solutions don’t meet their needs. They’re the ones modifying your product, combining it with other tools, or using it in completely unexpected contexts.

How to implement it:

Phase 1: Assemble Your Innovation Team

•Include a “power promoter” (senior leader with budget authority)

•Add a “specialist promoter” (technical expert from R&D)

•Bring in a “process promoter” (product manager or market-facing role)

•Keep the team small (around 5 people) but interdisciplinary

Phase 2: Define Your Search Area

•Be specific about technical boundaries

•Set realistic timelines for prototyping

•Identify analogous industries that are more advanced than yours

•Balance being “as narrow as necessary and as broad as possible”

Phase 3: Find Your Lead Users

•Start with your existing customer base—who’s using your product in unusual ways?

•Look to adjacent industries with similar technical challenges

•Search for users who have already modified or extended your product

•Conduct screening interviews to identify true innovators

Phase 4: Co-Create Solutions

•Host a 2-day lead user workshop

•Day 1: Generate ideas without constraints (ignore cost and feasibility initially)

•Day 2: Develop detailed specifications for the most promising concepts

•Have participants vote on feasibility and market potential

The result? Not dozens of mediocre ideas, but a handful of breakthrough concepts that are both radical and feasible.

2. Jobs to Be Done: Decode Why Customers “Hire” Your Product

Harvard professor Clayton Christensen’s Jobs to Be Done (JTBD) framework asks a deceptively simple question: What “job” is the customer hiring your product to do?

The answer is often surprising. In Christensen’s famous example, a fast-food chain discovered that customers weren’t buying milkshakes because they wanted a drink—they were “hiring” the milkshake to make their boring morning commute more interesting.

When you see a customer using your product in an unexpected way, JTBD gives you the lens to understand why. What progress are they trying to make? What job are they trying to get done?

How to apply it:

•When you observe unusual product usage, ask: “What job is this customer trying to accomplish?”

•Look beyond functional needs to social and emotional dimensions

•Recognize that the same customer might “hire” your product for different jobs in different contexts

•Design solutions around the job, not just the product features

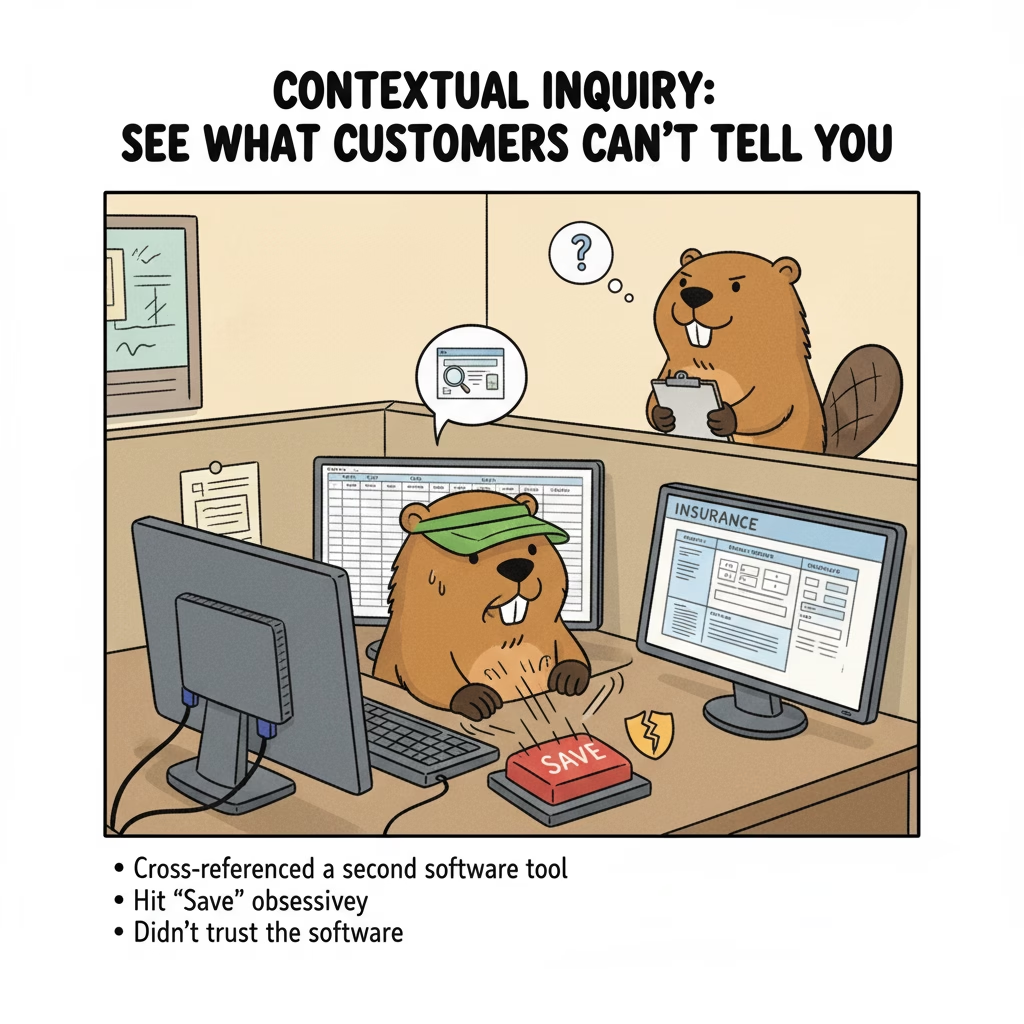

3. Contextual Inquiry: See What Customers Can’t Tell You

Developed by Beyer and Holtzblatt, Contextual Inquiry is based on a crucial insight: users can’t accurately describe their own work processes when removed from the context of actually doing the work.

Think of it as an apprenticeship model—you’re the apprentice, and your customer is the master craftsman. You observe them in their natural environment, watch them work, and ask questions in real-time.

Why it works:

One UX researcher redesigning insurance software interviewed specialists who said they “copy data from spreadsheets and paste it into the system.” Simple enough, right?

But when she actually watched them work, she discovered:

•They were cross-referencing a second software tool for missing information

•They hit “Save” obsessively after every entry, even though the system auto-saved

•They didn’t trust the software to save their work

These insights—which would never have emerged from an interview—fundamentally changed the product design.

How to implement it:

•Observe users in their actual work environment (not a conference room or lab)

•Watch them perform real tasks, not demonstrations

•Ask “why” questions in the moment: “Why did you do that?” “What are you checking?”

•Look for workarounds, repeated actions, and signs of frustration

•Document everything—photos, notes, even “superstitious behaviors” that seem illogical

Real-World Results: What Happens When You Get This Right

3M Post-it Notes: 12 Years From “Failed Adhesive” to Office Essential

In 1968, 3M scientist Spencer Silver accidentally created a weak, reusable adhesive while trying to make a super-strong one. Management saw no value in a “non-sticky” adhesive. For five years, the invention sat unused.

The breakthrough came from internal user behavior. Art Fry, another 3M employee, was frustrated with bookmarks falling out of his church hymnal. He realized Silver’s adhesive could create reusable bookmarks.

Even then, the product faced resistance. A 1977 market test in four cities flopped—hardly anyone bought it. But product champion Geoff Nicholson had a theory: people didn’t understand the value until they experienced it.

In 1978, 3M sent free samples to companies and tracked reorders. 90% of companies that tried the product reordered. The market existed—it just couldn’t be discovered through traditional research.

Post-it Notes launched nationally in 1980 and became one of the best-selling office products of all time. Total time from discovery to market success: 12 years.

Raspberry Pi: $35 Computer Becomes Industrial IoT Platform

The Raspberry Pi was created as a $35 educational computer to teach programming in schools. Its affordability and flexibility led to explosive adoption by hobbyists, researchers, and eventually, professional engineers.

Users began deploying Raspberry Pi for:

•Home automation systems

•Scientific research and data acquisition

•Industrial process control

•Healthcare monitoring devices

•Agricultural automation

The Raspberry Pi Foundation responded by creating multiple product lines for different user segments and eventually launched “Raspberry Pi for Industry”—certified, production-ready boards for commercial applications.

The company didn’t pivot away from education. They followed their users into new markets, creating a multi-hundred-million-dollar business by observing and responding to emergent behavior.

Your Action Plan: Start Discovering Hidden Markets This Quarter

You don’t need to wait years to start benefiting from these approaches. Here’s how to begin:

Week 1-2: Audit Your Current User Base

Immediate actions:

•Review support tickets for “unusual” use cases or feature requests that don’t fit your product roadmap

•Talk to your sales team: Which customers are using your product in unexpected ways?

•Check online forums, user groups, or communities where your customers gather

•Look for customers who’ve modified, extended, or combined your product with other tools

What you’re looking for:

•Patterns in “off-label” usage

•Workarounds customers have created

•Industries you didn’t target that are using your product

•Feature requests that seem to come from a different market entirely

Week 3-4: Conduct 3-5 Contextual Observations

Pick your targets:

•Choose customers who represent different use cases

•Prioritize those using your product in unexpected ways

•Include at least one customer from an adjacent industry

During the visit:

•Observe for at least 2-3 hours (longer for complex workflows)

•Take detailed notes and photos

•Ask “why” questions without being disruptive

•Look for pain points, workarounds, and creative adaptations

•Pay attention to what they do, not just what they say

Month 2: Identify Your Lead Users

Screening criteria:

•Are they facing needs ahead of your mainstream market?

•Have they already innovated or modified your product?

•Do they have significant motivation to find solutions (high stakes)?

•Can they articulate their needs and collaborate on solutions?

Build relationships:

•Invite them to advisory boards or beta programs

•Create formal partnerships for co-development

•Consider hosting a lead user workshop (2-day format)

Month 3: Test and Validate

Before investing heavily:

•Create minimal prototypes of the most promising concepts

•Test with both lead users and mainstream customers

•Assess market size and commercial viability

•Determine if this is a new product line, feature, or entirely new market

Build the Organizational Muscle

Long-term culture shifts:

•Train your product and engineering teams in observational research methods

•Create incentives for discovering new applications (not just executing the roadmap)

•Establish regular “field visit” requirements for product managers

•Share customer observation insights across the organization

•Celebrate examples of emergent user behavior, even if they don’t immediately lead to products

The Bottom Line: Stop Asking, Start Observing

The most transformative B2B innovations rarely come from asking customers what they want. They come from observing what customers are already doing—the creative adaptations, the workarounds, the “hacks” that reveal unmet needs and entirely new markets.

NVIDIA didn’t ask AI researchers what kind of chip they needed. Arduino didn’t survey industrial engineers about IoT platforms. Raspberry Pi didn’t conduct focus groups with factory managers.

They watched. They listened. They followed their users into unexpected territories.

Your customers are already showing you where your next billion-dollar opportunity lies. The question is: Are you paying attention?

Ready to Discover Your Hidden Market Opportunities?

The frameworks and methods in this article aren’t theoretical—they’re proven approaches used by companies that have unlocked transformative growth by moving beyond the feedback loop.

Start this week:

1.Identify 3 customers using your product in unexpected ways

2.Schedule on-site observation visits

3.Ask your team: “What are customers doing with our product that we never intended?”

The future of your business might already be happening in your customer base. You just need to look.

About the Research: This article synthesizes case studies from NVIDIA, Arduino, Corning, 3M, and Raspberry Pi, along with academic frameworks from Eric von Hippel (MIT), Clayton Christensen (Harvard), and leading UX research methodologies. All examples are based on documented company histories and peer-reviewed research.

Want to dive deeper? The Lead User Method, Jobs to Be Done framework, and Contextual Inquiry are established methodologies with extensive literature and training programs available. Consider bringing in external facilitators for your first lead user workshop—the ROI can be substantial.